Understanding Rent-to-Own Cars

Rent-to-own cars present a unique opportunity for individuals who face challenges in obtaining traditional car financing. This arrangement allows potential car owners to rent a vehicle with the option to purchase it at the end of the rental period. Unlike conventional car loans, rent-to-own agreements often do not require a credit check, making them accessible to those with poor or no credit history.

The process typically involves a contractual agreement where the renter pays a monthly fee that covers both the rental and a portion of the vehicle’s purchase price. Over time, these payments accumulate, and at the end of the term, the renter has the option to buy the car outright. This can be particularly appealing for individuals who are rebuilding their credit or who have faced financial hardships in the past.

However, while rent-to-own agreements offer flexibility, they also come with certain considerations:

- Higher Overall Cost: The total cost of a rent-to-own car can be higher than purchasing a vehicle outright due to interest and fees included in the monthly payments.

- Limited Vehicle Options: The selection of cars available for rent-to-own can be limited compared to traditional dealerships.

- Ownership Conditions: The car remains under the ownership of the dealership until the full payment is made, which means the renter must adhere to specific maintenance and usage guidelines.

Despite these considerations, rent-to-own vehicles remain a viable option for many, offering a pathway to ownership for those who might otherwise be excluded from the market.

Advantages of Rent-to-Own Cars

Rent-to-own cars provide several advantages that make them an attractive option for certain buyers. The primary benefit is accessibility. For individuals with poor credit scores or those who have experienced financial difficulties, traditional financing options can be challenging to secure. Rent-to-own agreements bypass the need for a credit check, offering a viable alternative to conventional car loans.

Another advantage is the flexibility in payment structures. Rent-to-own agreements often allow for more manageable monthly payments, which can be tailored to fit the renter’s budget. This flexibility can be crucial for individuals who need a vehicle for work or family commitments but cannot afford the upfront costs of purchasing a car outright.

Additionally, rent-to-own agreements can serve as a stepping stone to improving one’s credit score. By making consistent, on-time payments, renters can demonstrate financial responsibility, which may positively impact their credit history over time. This can open up more traditional financing options in the future.

Key advantages include:

- No Credit Check Required: Accessible for individuals with poor or no credit history.

- Flexible Payment Options: Monthly payments can be adjusted to fit the renter’s budget.

- Potential Credit Improvement: Consistent payments can help improve credit scores over time.

These benefits make rent-to-own cars a compelling choice for those seeking flexibility and a pathway to vehicle ownership without the constraints of traditional credit requirements.

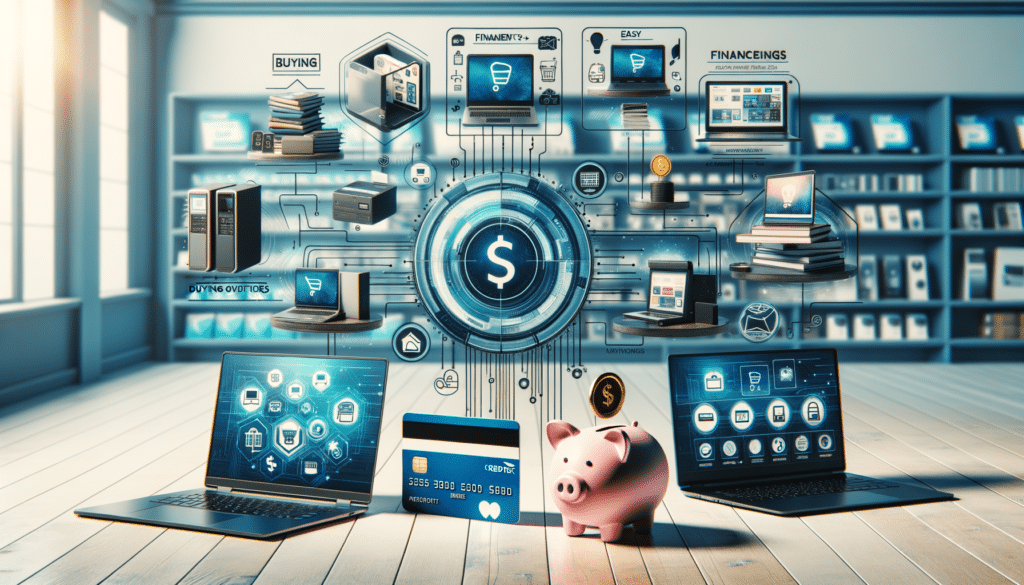

Considerations Before Choosing Rent-to-Own

While rent-to-own cars offer numerous benefits, potential renters should carefully consider certain factors before entering into an agreement. One of the primary considerations is the overall cost. Rent-to-own agreements often result in a higher total payment compared to purchasing a car through traditional financing. This is due to the interest and additional fees that are typically included in the monthly payments.

Another important factor is the condition and maintenance of the vehicle. Since the car remains under the ownership of the dealership until the agreement is completed, renters must adhere to specific maintenance and usage guidelines. Failure to comply with these terms could result in penalties or even termination of the agreement.

Potential renters should also be aware of the limited selection of vehicles available through rent-to-own programs. The choices may be restricted compared to traditional dealerships, which could limit options in terms of make, model, and features.

Key considerations include:

- Higher Total Cost: Rent-to-own agreements may result in a higher overall payment due to interest and fees.

- Maintenance Obligations: Renters must adhere to specific maintenance guidelines set by the dealership.

- Limited Vehicle Selection: Choices may be restricted compared to traditional dealerships.

By understanding these factors, potential renters can make informed decisions and determine whether a rent-to-own car is the right choice for their needs and financial situation.